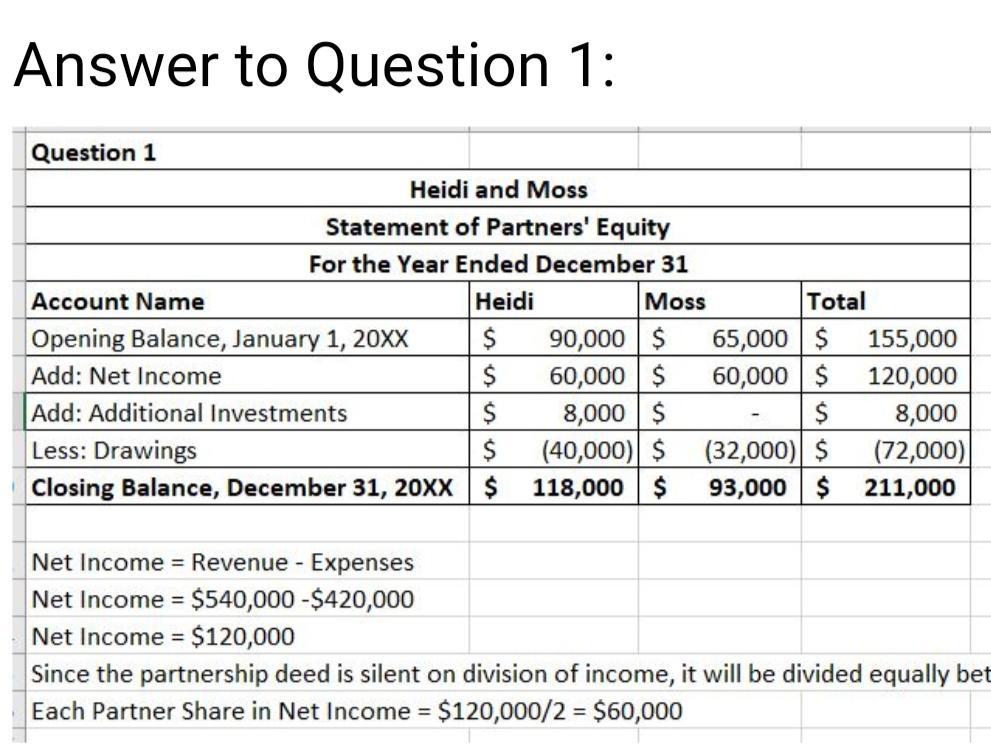

rrent fiscal year. On April 10, Heidi invested an additional $8,000. During the year, Heidi and Moss withdrew $40,000 and $32,000, respectively. Revenues were $540,000 and expenses were $420,000 for the year. The articles of partnership make no reference to the division of net income. Required: 1. Prepare a statement of partners' equity for the partnership of Heidi and Moss. If an amount box does not require an entry, leave it blank. Enter all amounts as positive numbers. Heidi and Moss Statement of Partners' Equity For the Year Ended December 31 Heidi Moss Total Capital, January 1 $ 90,000 $ 65,000 $ 155,000 Net income for the year 60,000 60,000 120,000 $ $ $ $ $ $ Withdrawals during the year Capital, December 31 $ 118,000 $ 93,000 $ 211,000 2. Journalize the entries to: Close the revenue and expenses account. Close the drawing accounts. If an amount box does not require an entry, leave it blank. a. Revenues 540,000 Heidi, Capital 540,000 Moss, Capital 420,000 Heidi, Capital 40,000 Moss, Capital Moss, Drawing b. Heidi, Capital 40,000 Moss, Capital 32,000 Heidi, Drawing 40,000 Moss, Drawing 32,000