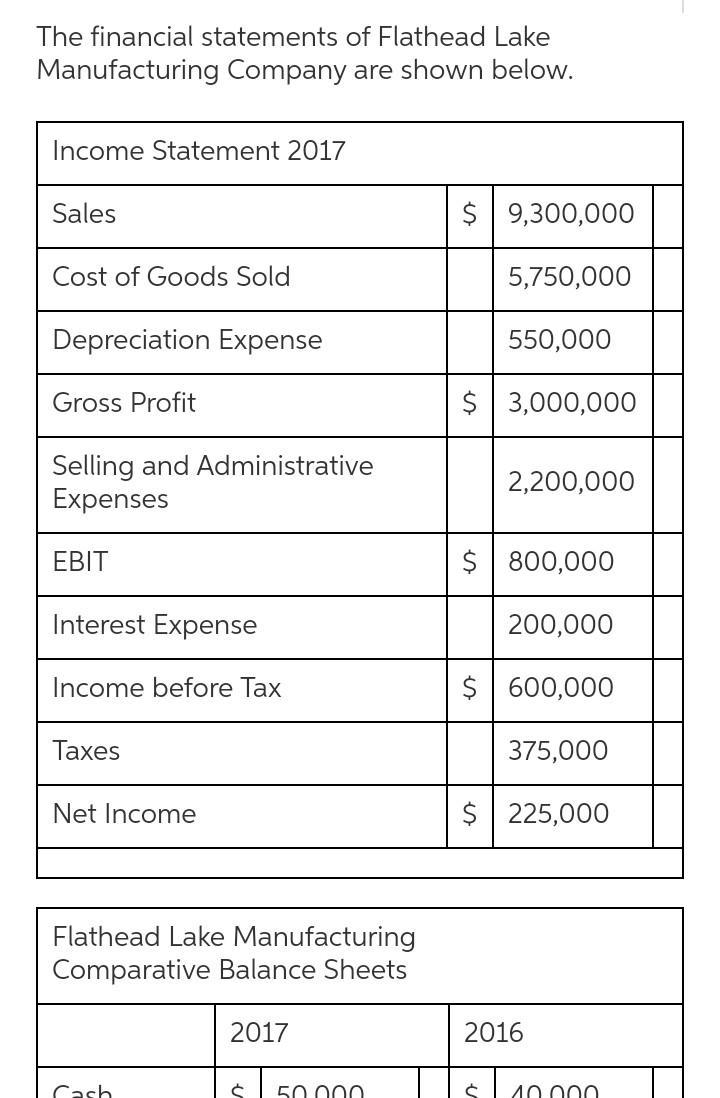

Goods Sold 5,750,000 Depreciation Expense 550,000 Gross Profit $ 3,000,000 Selling and Administrative Expenses 2,200,000 EBIT $ 800,000 Interest Expense 200,000 Income before Tax $ 600,000 Taxes 375,000 Net Income $ 225,000 Flathead Lake Manufacturing Comparative Balance Sheets 2017 2016 Cash $ 50,000 $ 40,000 Accounts Receivable 570,000 600,000 Inventory 530,000 460,000 Total Current Assets $ 1,150,000 $ 1,100,000 Fixed Assets 2,050,000 1,400,000 Total Assets $ 3,200,000 $ 2,500,000 Accounts Payable $ 320,000 $ 300,000 Bank Loans 480,000 400,000 Total Current Liabilities $ 800,000 $ 700,000 Long-term Bonds 1,500,000 1,000,000 Total Liabilities $ 2,300,000 $ 1,700,000 Common Stock (200,000 shares) 200,000 200,000 Retainded Earnings 700,000 600,000 Total Equity $ 900,000 $ 800,000 Total Liabilities and Equity $ 3,200,000 $ 2,500,000 Note: The common shares are trading in the stock market for $15 per share. Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's return on equity ratio for 2017 is _________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)