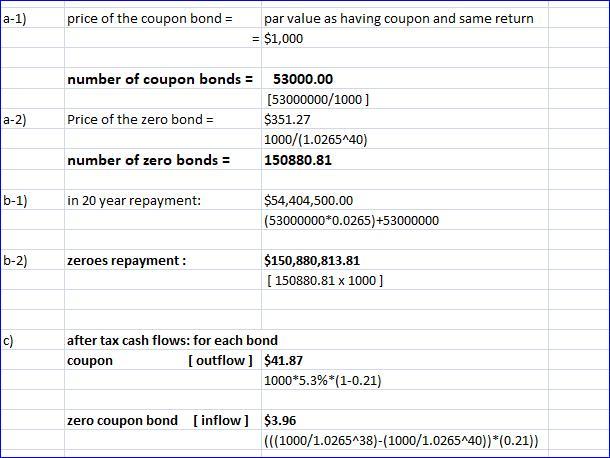

on your bond issue will be 5.3 percent, and you’re evaluating two issue alternatives: a semiannual coupon bond with a coupon rate of 5.3 percent, and a zero coupon bond. Your company’s tax rate is 21 percent. Both bonds will have a par value of $1,000. a-1. How many of the coupon bonds would you need to issue to raise the $53 million? a-2. How many of the zeroes would you need to issue? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b-1. In 20 years, what will your company’s repayment be if you issue the coupon bonds? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) b-2. What if you issue the zeroes? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) c. Calculate the aftertax cash flows for the first year for each bond. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567. Enter your answers as positive numbers.)